Cell therapy was born in the 1930s when Paul Niehans earned the title of “father of cell therapy” by injecting the cells of animal organs into patients with numerous conditions including cancer. Although cell therapy was discovered nearly a century ago, new advances and techniques have caused a large increase in life science cell therapy research, and the industry is predicted to continue to grow exponentially in the next five years. The last decade saw the first human clinical trial using induced pluripotent stem cells (iPSCs), as well as the major milestone of the first FDA-approved chimeric antigen receptor t-cell (CAR-T) therapeutics. Furthermore, the national cancer institute reported that the number of active clinical cell therapy trials in 2021 has increased by 76% since 2019.

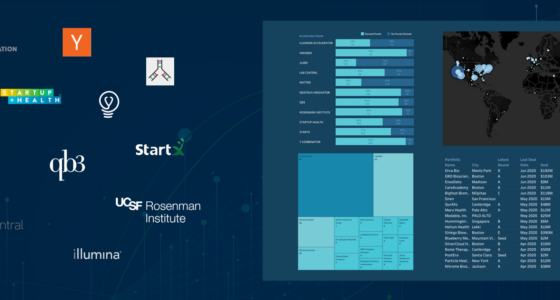

CipherBio PRO Cell Therapy Insights

CipherBio PRO’s Cell Therapy Insights explores the investments and science of cell therapy biotechnology companies that received funding from 2019-2021. 135 companies working on 206 indications with 490 approaches received a total of $18 Billion from 438 investors. Additionally, these companies are broken down into their respective clinical phases.

T-Cell Therapies

A major reason for the increase in cell therapy is the promise shown by t-cell based immunotherapies for cancers. There are four types of t-cell based immunotherapies including tumor-infiltrating lymphocyte (TIL) therapy, T cell receptor (TCR) therapy, chimeric antigen receptor (CAR-T) cell therapy, and natural killer (NK) cell therapy. Only CAR-T therapies have received approval while the others are still experimental. In 2017 the FDA approved the first two CAR-T therapies: Novartis’ Kymriah for pediatric B-cell precursor acute lymphoblastic leukemia (ALL) and Kite Pharma’s Yescarta for Large B-cell lymphoma.

45 companies are working on t-cell therapies and 29 are CAR-T therapy companies accounting for $7 Billion in funds raised from 2019-2021. The farthest along in clinical trials is China-based JW Therapeutics. Their CAR-T product, JWCAR029, is under review after a new drug application (NDA) was accepted following successful phase 2 trials as a third-line treatment for patients with diffuse large B-cell lymphoma (DLBCL). JW Therapeutics went public in November 2020 with a $300 Million IPO just a few months after raising a $100 Million Series B led by CPE and Mirae Asset.

Stem Cell Therapies

Although t-cell therapies top the approach list and have been at the forefront of recent cell therapy advancements, stem cells have shown promising results for decades and have the potential for further success. Stem cell therapy has been around for over 60 years, with the first treatment in the form of a bone marrow transplant for leukemia treatment. Presently, stem cell therapy, as a form of regenerative medicine is used to treat a variety of conditions including neurological, autoimmune, tissue, cardiovascular, cancers and injuries. 22 companies are working on stem cell therapeutics for 71 different indications and account for $2.1 Billion raised from 78 investors. The top indication that these stem cell therapies target is neurological disorders, followed by autoimmune diseases.

Farthest along in clinical trials is Louisville-based Talaris Therapeutics who raised a $115 Million Series B round in October 2020 led by Surveyor Capital and Viking Global Investors and then went public in May 2021 with a $150M IPO. Talaris recently initiated a phase 3 trial for their lead product candidate FCR001, an allogeneic hematopoietic stem cell transplant used to mitigate the risks associated with solid organ transplant. Although Talaris is furthest along in trials, preclinical stage Century Therapeutics raised the biggest round. The Philadelphia-based biotech company, founded in 2018, emerged from stealth mode in 2019 with a $250 Series A from Bayer, Versant and Fujifilm Cellular Dynamics Inc. (FCDI). In March 2021 Century completed a $160 Million Series C round led by Casdin Capital, and just three months later the company went public with a $242 Million IPO. Century’s platform focuses on induced pluripotent stem cell (iPSC)-derived cell therapies for immuno-oncology targets.

Top Investor

One of Century’s investors, RA Capital Management topped the investor list by investing in 13 cell therapy companies and participating in rounds totaling $2.9 Billion. RA Capital is a Boston-based multi-stage investment manager making investments in healthcare and life science companies. Scaling in on the specifics of these 13 companies, 11 are working on cancer indications and 4 on autoimmune diseases. 9 of the companies are using t-cell therapy approaches and 3 are using natural killer (NK) cell therapy, an emerging approach used as an alternate method from t-cells for cancer immunotherapy. Of the 13 companies, 5 went public in 2020 or 2021 all through large IPOs. ViaCyte is farthest along in clinical trials, 3 companies have products in phase 1/2 and 1 has products in phase 1, and the rest are preclinical.

One of Century’s investors, RA Capital Management topped the investor list by investing in 13 cell therapy companies and participating in rounds totaling $2.9 Billion. RA Capital is a Boston-based multi-stage investment manager making investments in healthcare and life science companies. Scaling in on the specifics of these 13 companies, 11 are working on cancer indications and 4 on autoimmune diseases. 9 of the companies are using t-cell therapy approaches and 3 are using natural killer (NK) cell therapy, an emerging approach used as an alternate method from t-cells for cancer immunotherapy. Of the 13 companies, 5 went public in 2020 or 2021 all through large IPOs. ViaCyte is farthest along in clinical trials, 3 companies have products in phase 1/2 and 1 has products in phase 1, and the rest are preclinical.

RA Capital Management’s Companies

| Company | Investment Date | Round | Amount | Indications |

|---|---|---|---|---|

| March 2021 | Series C | $52.6M | hematologic cancers, solid tumor cancers | |

| April 2020 | Series B | $50M | NHL, AML, TCL, DLBCL, FL), solid tumor cancers (gastric, pancreatic, ovarian), HIV | |

| February 2021 | Series B | $30M | B-cell cancers, solid tumor cancers | |

| September 2019 | Series B | $32M | NSCLC, Melanoma, HNSCC, RCC | |

| September 2019 | Series B | $25M | AML, MDS, HCC, CRC, b-cell cancers | |

| July 2020 | Series B | $20M | AML, MDS, MPN | |

| June 2021 | Series B | $52.6M | Cancer, autoimmune diseases | |

| January 2021 | Series C | $50M | AML, MDS, ALL, Cervical, NSCLC, Melanoma | |

| August 2021 | Series A | $30M | Gastrointestinal, pulmonary, gynecologic, urogenital, and solid tumors | |

| May 2021 | Series A | $32M | cancers | |

| October 2020 | Series A | $25M | cancers, autoimmune diseases, infectious diseases, enzyme deficiencies | |

| May 2020 | Series D | $20M | Diabetes | |

| August 2020 | Seed | $20M | autoimmune, autoinflammatory allergic diseases |

Cell Therapy Manufacturers

Cell therapy is a flourishing area of the life sciences encompassing a variety of approaches targeting a wide range of diseases and conditions. 2021 has begun to be a prosperous year for cell therapy with 77 deals totaling $8.8 Billion, already beating the $7.1 Billion raised in 2020.