Digital therapeutics are quickly rising in popularity, with the advancement of technology such as artificial intelligence and machine learning. Digital therapeutics are defined as clinically evaluated software systems used as medical interventions to treat or manage medical conditions. The digital therapeutics field includes Software as a Medical Device (SAMD) which performs as a medical device without being a part of a hardware medical device. Digital therapeutics introduces a new class of potential therapies that may be more effective than traditional medicine. The FDA recently provided new guidance for a clinical path which allowed the first digital therapeutics innovators to receive FDA approval for their therapies.

Table of Contents

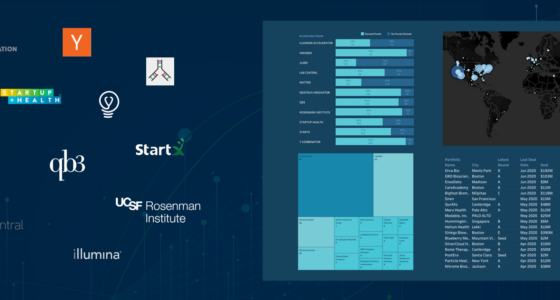

CipherBio PRO Digital Therapeutics Insights

CipherBio PRO Digital Therapeutics Insight reveals 81 total digital therapeutics companies received $3.1 Billion from 302 investors between 2019 and 2021. Investments in digital therapeutics have been growing rapidly in the past 3 years. To date 2021 already has 42 deals, on par with the entirety of 2019, and close behind 2020 46 deals. More notably, 2021 has already seen $1.9B in investments, almost four times 2019’s $419M, and more than double 2020 $781M. Additionally, Business Insider predicts the digital therapeutics market will grow to $56B globally by 2025.

See Digital Therapeutics Insights

Neurological Disorders and Cognitive Behavioral Therapy

Digital therapeutics primarily focus on neurological disorders (12 products), mental health (10 products), psychiatric conditions (8 products) and diabetes (7 products). Because of the coronavirus lockdowns, the FDA recently loosened regulatory rules surrounding digital therapeutics in the mental health sphere to no longer require a 510K, allowing these types of products to hit the market sooner.

One of the most common digital therapeutic approaches is cognitive behavioral, tying in with digital therapeutics’ clear focus on mental healthcare. Cognitive behavioral therapy is a type of psychotherapy where patients attend sessions with a therapist to talk through how to better manage challenging situations and negative thinking. Currently, Digital therapeutics allows CBT to treat patients beyond therapist visits, for either more convenient or more often treatments. For example, Pear Therapeutics offers their digital therapeutic platform reSET, which is an FDA approved program for substance abuse and opioid abuse. The program utilizes cognitive behavioral therapy and includes lessons, compliance rewards, substance-use reporting, and a provider dashboard to help patients manage addiction on an online platform. Pear Therapeutics had the largest deal in the digital therapeutics sphere when they recently went public with a $400M SPAC deal with Thimble Point Acquisition Corp. on June 22nd, after raising $284M in total capital since 2016.

One of the most common digital therapeutic approaches is cognitive behavioral, tying in with digital therapeutics’ clear focus on mental healthcare. Cognitive behavioral therapy is a type of psychotherapy where patients attend sessions with a therapist to talk through how to better manage challenging situations and negative thinking. Currently, Digital therapeutics allows CBT to treat patients beyond therapist visits, for either more convenient or more often treatments. For example, Pear Therapeutics offers their digital therapeutic platform reSET, which is an FDA approved program for substance abuse and opioid abuse. The program utilizes cognitive behavioral therapy and includes lessons, compliance rewards, substance-use reporting, and a provider dashboard to help patients manage addiction on an online platform. Pear Therapeutics had the largest deal in the digital therapeutics sphere when they recently went public with a $400M SPAC deal with Thimble Point Acquisition Corp. on June 22nd, after raising $284M in total capital since 2016.

Koa Health offers a similar digital therapeutic platform with an FDA approved 8-step CBT program on their mobile app for patients with depression. The app provides exercises for patients and a dashboard for providers to track progress. A digital platform allows for more patients to receive treatment as a mobile app is both more convenient and more cost-effective than attending therapy sessions, thus helping to bring down the statistic that 57% of people in the US with a mental illness do not receive treatment. Koa most recently raised a $36M series A on February 9th led by Wellington Partners Life Sciences and Ancora Finance Group.

Koa Health offers a similar digital therapeutic platform with an FDA approved 8-step CBT program on their mobile app for patients with depression. The app provides exercises for patients and a dashboard for providers to track progress. A digital platform allows for more patients to receive treatment as a mobile app is both more convenient and more cost-effective than attending therapy sessions, thus helping to bring down the statistic that 57% of people in the US with a mental illness do not receive treatment. Koa most recently raised a $36M series A on February 9th led by Wellington Partners Life Sciences and Ancora Finance Group.

Finally, Oxford VR offers a medical use for new technology: virtual reality. Oxford uses virtual reality to deliver cognitive behavioral therapy to patients looking to conquer their fears and ease anxieties such as fear of heights or social anxiety. Virtual reality allows patients to face their fears from home, with an automated therapist. Oxford VR most recently raised a $12.5M series A on February 12th led by Optum Ventures and backed by Luminous Ventures. Optum Ventures has participated in five deals with digital therapeutic companies, the second most after Jazz Ventures, which participated in seven.

Finally, Oxford VR offers a medical use for new technology: virtual reality. Oxford uses virtual reality to deliver cognitive behavioral therapy to patients looking to conquer their fears and ease anxieties such as fear of heights or social anxiety. Virtual reality allows patients to face their fears from home, with an automated therapist. Oxford VR most recently raised a $12.5M series A on February 12th led by Optum Ventures and backed by Luminous Ventures. Optum Ventures has participated in five deals with digital therapeutic companies, the second most after Jazz Ventures, which participated in seven.

Top Investor by Deal Count

A big participant in the neuro space, Jazz Venture Partners, a venture capital firm out of San Francisco, CA, is the top investor with seven investments made in digital therapeutics from 2019-2021. The firm invests in companies focused on “human performance technology” and neurobiology, and of the seven invested DT companies, five are working on neurological and psychiatric disorders. 6 products developed by these companies already have FDA approval, 4 are at the pivotal stage, and 7 are at POC. With seven total investments, four of which are within 6 months of each other, Jazz Ventures is betting on the potential of the digital therapeutic space.

A big participant in the neuro space, Jazz Venture Partners, a venture capital firm out of San Francisco, CA, is the top investor with seven investments made in digital therapeutics from 2019-2021. The firm invests in companies focused on “human performance technology” and neurobiology, and of the seven invested DT companies, five are working on neurological and psychiatric disorders. 6 products developed by these companies already have FDA approval, 4 are at the pivotal stage, and 7 are at POC. With seven total investments, four of which are within 6 months of each other, Jazz Ventures is betting on the potential of the digital therapeutic space.

Jazz Venture Partners Investments

| Company | Investment Date | Round | Amount | Indications | Clinical Stage |

|---|---|---|---|---|---|

| May 2021 | Series D | $110M | Autism, ADHD, cognition disorders | 1 regulatory approval, 1 POC, 3 discovery | |

| June 2021 | Series B | $90M | depression, substance use disorder | 2 POC, 1 discovery | |

| December 2020 | Series D | $80M | substance use disorder, multiple sclerosis, Schizophrenia, Insomnia | 3 regulatory approval, 1 POC, and 1 Pivotal | |

| March 2021 | Series A | $29M | Pain, anxiety | 2 regulatory approval, 2 POC, and 1 discovery | |

| March 2021 | Series A | $26.3M | Mental health | 1 Pivotal, 1 POC, and 1 Feasibility | |

| January 2021 | Series A | $12M | Irritable bowel syndrome | 1 regulatory approval | |

| February 2020 | Acquisition | eye diseases, blindness | 1 regulatory approval |

$381M in Deals Targeting Diabetes

After neurological disorders, the next most common indication targeted by digital therapeutics is diabetes. Five products targeting diabetes are FDA approved, including Holmusk, who had the biggest deal of the diabetes companies, a $21.5M Series A led by Optum Ventures and Health Catalyst Capital. Holmusk’s product helps patients with chronic diseases like diabetes and obesity lose weight and lower their A1C with a mobile dietician coach and blood glucose and weight tracking. $381M, over 7 deals, has been invested into digital therapeutics companies targeting diabetes.

After neurological disorders, the next most common indication targeted by digital therapeutics is diabetes. Five products targeting diabetes are FDA approved, including Holmusk, who had the biggest deal of the diabetes companies, a $21.5M Series A led by Optum Ventures and Health Catalyst Capital. Holmusk’s product helps patients with chronic diseases like diabetes and obesity lose weight and lower their A1C with a mobile dietician coach and blood glucose and weight tracking. $381M, over 7 deals, has been invested into digital therapeutics companies targeting diabetes.

Digital therapeutics offer patients the advantage of lower cost, more frequent, and more convenient treatment. During the Covid-19 pandemic, digital therapeutics came to the rescue during a time when virtual care became a necessity. With the digital therapeutics industry already delivering successful products and substantial growth, this field only seems to be ramping up.