Here’s an energizing topic: metabolism.

Metabolism is the essential and fundamental process your body performs to make energy from the food you eat.

But when just one step along the complex metabolic process fails, the body retains either too much or too little of one of the many essential substances it needs to maintain optimal health, causing a metabolic disorder.

Metabolic disorders can be inherited and are known as inborn errors of metabolism. They can also develop throughout one’s lifetime. The most common metabolic disorder, diabetes, is diagnosed in about 1.5 million Americans each year, according to the American Diabetes Association.

On the Rise

Amid growing rates and concern about the severity of metabolic disorders, there has also been a remarkable increase in the number of life science and biotech companies dedicated to discovering solutions.

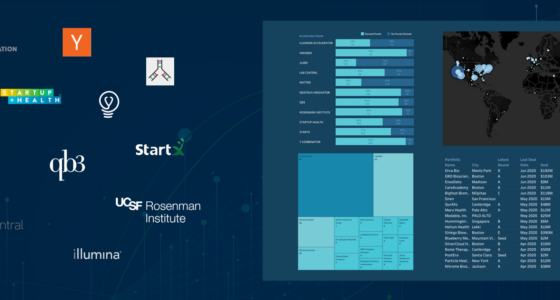

CipherBio PRO dives into the booming metabolic disorder sector.

When taking a look at the companies that received funding in 2019, 2020 and 2021 Q1, CipherBio’s metabolic insight reveals 76 companies, 258 investors, over $15B in invested capital, just shy of 200 indications and 300 approaches. Of these companies, 52 remain in the preclinical stage, showing the untapped potential and growing curiosity for this field of devastating disorders.

Among the 52 preclinical companies beginning their quest in this up-and-coming field is Beam Therapeutics, a Cambridge, Massachusetts-based editing platform, which secured the largest deal. The biotech, hoping to combat glycogen storage disease with its next-generation CRISPR technologies, closed a $207M IPO in February 2020, before acquiring Guide Therapeutics the following February for $120M — and in a deal that ultimately could be worth up to $320M. Beam plans to use Guide’s lipid nanoparticle delivery platform to further its genetic therapies.

Among the 52 preclinical companies beginning their quest in this up-and-coming field is Beam Therapeutics, a Cambridge, Massachusetts-based editing platform, which secured the largest deal. The biotech, hoping to combat glycogen storage disease with its next-generation CRISPR technologies, closed a $207M IPO in February 2020, before acquiring Guide Therapeutics the following February for $120M — and in a deal that ultimately could be worth up to $320M. Beam plans to use Guide’s lipid nanoparticle delivery platform to further its genetic therapies.

The largest acquisition in the field goes to Spark Therapeutics Inc., a Philadelphia-based gene therapy company. The biotech was acquired in February 2019 by Swiss giant Roche for $4.3B. The deal advanced Roche’s multiple clinical and preclinical efforts, including a Phase 1/2 therapy for the treatment of Pompe disease.

The largest acquisition in the field goes to Spark Therapeutics Inc., a Philadelphia-based gene therapy company. The biotech was acquired in February 2019 by Swiss giant Roche for $4.3B. The deal advanced Roche’s multiple clinical and preclinical efforts, including a Phase 1/2 therapy for the treatment of Pompe disease.

A recent star in the metabolic world has been Asklepios BioPharmaceuticals (AskBio), which was acquired by Bayer in October 2019 for $2B. The company had previously received a $235M Series A led by Vida Ventures and TPG Biotech to advance its clinical programs, including one of its lead AAV gene therapies for the treatment of Pompe disease, an inherited disorder in which the build-up of a complex sugar called glycogen in cells keeps the body from functioning properly.

A recent star in the metabolic world has been Asklepios BioPharmaceuticals (AskBio), which was acquired by Bayer in October 2019 for $2B. The company had previously received a $235M Series A led by Vida Ventures and TPG Biotech to advance its clinical programs, including one of its lead AAV gene therapies for the treatment of Pompe disease, an inherited disorder in which the build-up of a complex sugar called glycogen in cells keeps the body from functioning properly.

With the success and funding of these biotechs, it is no surprise that gene therapy appears as one of the prominent approaches associated with metabolic diseases. Though the small molecule approach beats out gene therapy in total number of companies investing, gene therapy has amassed an astonishing $2B in total investments, nearly doubling the investment in small molecule.

Interested in other companies in the gene therapy sector?

Gene Therapy Building Long-Awaited Momentum

Gene Therapy Building Long-Awaited Momentum

Gene therapy is one of the hottest, most eye-opening areas in the life sciences right now. Its earliest victories happened more than 30 years ago, but, since then, gene therapy has struggled to build momentum — until now.

Greater Early Stage Funding

With the increasing potential of gene therapies and the prevalence of metabolic disorders, we are seeing greater early-stage funding at the intersection of the two. The largest seed round is Taysha Gene Therapies, an adeno-associated virus (AAV) gene therapy company, which in April 2020 received $30M to target various lysosomal storage diseases. For Series A, the previously mentioned AskBio takes the top spot with $235M in April 2019 for its AAV treatment for Pompe disease. Finally, the gene editing and CRISPR biotech Graphite Bio closed a $150M Series B in March 2021 for its multiple preclinical metabolic indications.

One of the most prominent metabolic disorders we are seeing is non-alcoholic steatohepatitis (NASH), an advanced form of non-alcoholic fatty liver disease (NAFLD), which is initiated by a buildup of fat in the liver. NASH is one of the most rapidly growing health concerns in the world, with its prevalence expected to increase by 63% by 2030 according to the Nash Education Program. With such alarming predictions, it’s no surprise that NASH takes the position of top metabolic indication with $1.3B invested from 11 companies. NASH has begun to occupy the minds of life science companies and the pockets of investors due to the fact that the FDA has yet to approve any drugs for the treatment of this rising disease — and every company wants to receive that coveted approval first.

Among the group of biotechs seeking to produce the first FDA approved NASH drug, 89Bio recognizes the magnitude of NASH severity with the driving force of the worldwide obesity epidemic, noting that NAFLD affects 25% of the global population, and NASH develops in 20-25% of these cases. In November 2019, the biopharma company received the largest NASH funding event, closing a $97.6 M IPO to further develop its Phase ½ NASH product.

Among the group of biotechs seeking to produce the first FDA approved NASH drug, 89Bio recognizes the magnitude of NASH severity with the driving force of the worldwide obesity epidemic, noting that NAFLD affects 25% of the global population, and NASH develops in 20-25% of these cases. In November 2019, the biopharma company received the largest NASH funding event, closing a $97.6 M IPO to further develop its Phase ½ NASH product.

Focused on Type 2 Diabetes, Sana Biotechnology received the largest investment, a $700M Series A backed by Arch Venture Partners, Flagship Pioneering, Canada Pension Investment Board, and more to further its engineered cell platform.

Focused on Type 2 Diabetes, Sana Biotechnology received the largest investment, a $700M Series A backed by Arch Venture Partners, Flagship Pioneering, Canada Pension Investment Board, and more to further its engineered cell platform.

This year has already seen an accumulated over $20B in just 21 investments, proving the growing acknowledgment of the severity of these disorders and the need for solutions.

We’re energized about advances within metabolic disorders.

To delve into the companies continuing this monumental work, and learn more about CipherBio PRO.

Access CipherBio PRO Learn More

Already using CipherBio PRO?

Thank you, and we want to hear about it. Tell us what you are finding interesting as you dig into the data.

Give us a call at

1-888-420-4752