The life science M&A trend is not slowing down.

Nearly $30B has been poured into life science acquisitions year to date through May 2021.

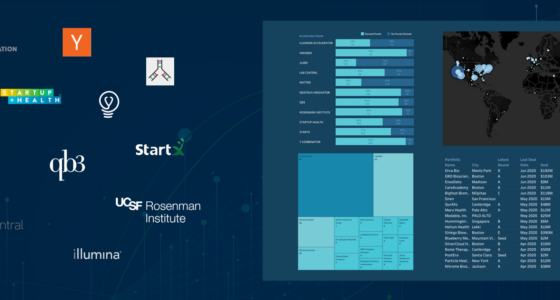

Not only does the CipherBio PRO M&A Insights reveal the top deals in 2019-2021, acquirers and investors, but it also highlights the data and scientific work behind these billion-dollar deals.

Just short of the top acquirer spot for 2019-2021, Gilead Sciences purchased five companies in 2020 with a combined total worth $28.2B. So, why did Gilead pinpoint these companies in particular, and in such a short amount of time? Looking at the company’s scientific approaches and indications provides one answer.

Just short of the top acquirer spot for 2019-2021, Gilead Sciences purchased five companies in 2020 with a combined total worth $28.2B. So, why did Gilead pinpoint these companies in particular, and in such a short amount of time? Looking at the company’s scientific approaches and indications provides one answer.

Four out of five of Gilead’s acquired companies focus on oncology, but it’s not only this broad indication that connects them. The scientific mechanism of action is another common thread. All four oncology-focused companies use immuno-oncology (immunotherapy specific for oncology) methods, meaning the drugs work by stimulating the body’s immune system to fight off cancer cells. The use of immunotherapeutics in oncology has recently gained traction in a search for an alternative to the main methods of cancer treatment, including chemotherapy, surgery and radiation. There are 5 types of immunotherapeutics, including adoptive cell therapy, cancer vaccines, immunomodulators, targeted antibodies and oncolytic virus therapy.

Diving deeper into Gilead’s immuno-oncology acquisitions, three of the four companies’ platforms are classified under the same immunotherapy method that uses a targeted antibody approach. Gilead claimed the second greatest acquisition of 2020 with its $21B acquisition of Immunomedics. This deal gave Gilead full access to Trodelvy, an antibody-drug conjugate seeking regulatory approval for the treatment of metastatic triple-negative breast cancer (mTNBC). Also using a targeted antibody approach are Forty Seven and Pionyr Immunotherapeutics, both of which are testing monoclonal antibody therapies in phase 1 trials.

Not only did Gilead focus on immuno-oncology companies, but nearly 9% of the companies acquired from 2019-2021 have immunotherapy platforms. However, Gilead’s acquisitions denote a much bigger trend: antibody-focused therapies. The second most prevalent approach, monoclonal antibodies, used by a surprising 14 % of the acquired companies, and that percentage only increases when including the companies working on all antibody-based therapies.

Antibody therapies have recently caught the public’s attention with the COVID-19 pandemic, during which monoclonal antibody-based drugs began to be used to help those who contracted the virus. Aside from COVID-19 therapeutics, monoclonal antibody treatments are being tested and have been approved to treat cancers, autoimmune diseases, asthma and more.

With the number of M&A deals in 2021 on track to surpass those in 2020, we can certainly expect more of the multi-billion dollar transactions. Why? Perhaps taking a look at the trends in the scientific methods used by these biotech companies begins to give an answer. For now the eyes seem to be on immunotherapy and antibody therapies.

See for yourself — Export M&A Deals exclusively on CipherBio PRO

Get involved in the game. Conduct levels of powerful due diligence usually reserved for the biggest firms, all with a few clicks.

Coming soon exclusively to CipherBio PRO: IPO + Data Insight. You’ll get the lowdown on IPOs, reverse mergers and the SPAC (Special Purpose Acquisition Company) phenomenon. Stay tuned – and don’t take your eye off the ball, or PRO.

To delve into the companies continuing this monumental work and learn more about CipherBio PRO.

Access CipherBio PRO Learn More

Already using CipherBio PRO?

Thank you, and we want to hear about it. Tell us what you are finding interesting as you dig into the data.

Give us a call at

1-888-420-4752